To expect the government of Settha 1, who had a history as a developer, to have a policy that would facilitate the real estate business until it returned to prosperity like the nation's era I must say that you will probably be disappointed in advance. Because the economic situation is so different in different agendas that they cannot be compared at all. In the National Era, there was a large amount of foreign investment, especially from Japan. Plus, natural gas was discovered in the Gulf of Thailand from Pa Prem's era. Has caused huge investments in the petrochemical industry and related industries from foreign countries unprecedented in Thailand Causing the national income (GDP) to grow at almost 10% for 3-4 consecutive years, so during the years 1993-1996, the real estate business which naturally grows according to GDP, then runs like a rocket The price of land has skyrocketed. Until it could almost be said that it happened day to day. Who bought speculative land during that time? There is almost no need to waste time designing, building, and selling. Seized land and released it for sale Just this and the profit can be doubled easily. Until the bubble burst during the year 1997 that we call Tom Yum Kung Crisis Land and real estate prices plummeted. Kind of looking for a place to find people who can't buy each other ever. People who used to be rich became wealthy yesterday, especially real estate business people who became bad debts, NPL (Non-Performing Loan), chasing assets until NPA (Non-Performing Asset) inferior quality assets filled the whole city. Plus other related loans have to be fixed for ten years. before entering the entrance has created wounds and lessons for the real estate businessman and bankers who lend in that era to this day Especially real estate business people become bad debts, NPL (Non-Performing Loan), chasing assets until NPA (Non-Performing Asset) inferior quality assets fill the whole city. Plus other related loans have to be fixed for ten years. before entering the entrance has created wounds and lessons for the real estate businessman and bankers who lend in that era to this day Especially real estate business people become bad debts, NPL (Non-Performing Loan), chasing assets until NPA (Non-Performing Asset) inferior quality assets fill the whole city. Plus other related loans have to be fixed for ten years. before entering the entrance has created wounds and lessons for the real estate businessman and bankers who lend in that era to this day

To expect the government of Settha 1, who had a history as a developer, to have a policy that would facilitate the real estate business until it returned to prosperity like the nation's era I must say that you will probably be disappointed in advance. Because the economic situation is so different in different agendas that they cannot be compared at all. In the National Era, there was a large amount of foreign investment, especially from Japan. Plus, natural gas was discovered in the Gulf of Thailand from Pa Prem's era. Has caused huge investments in the petrochemical industry and related industries from foreign countries unprecedented in Thailand Causing the national income (GDP) to grow at almost 10% for 3-4 consecutive years, so during the years 1993-1996, the real estate business which naturally grows according to GDP, then runs like a rocket The price of land has skyrocketed. Until it could almost be said that it happened day to day. Who bought speculative land during that time? There is almost no need to waste time designing, building, and selling. Seized land and released it for sale Just this and the profit can be doubled easily. Until the bubble burst during the year 1997 that we call Tom Yum Kung Crisis Land and real estate prices plummeted. Kind of looking for a place to find people who can't buy each other ever. People who used to be rich became wealthy yesterday, especially real estate business people who became bad debts, NPL (Non-Performing Loan), chasing assets until NPA (Non-Performing Asset) inferior quality assets filled the whole city. Plus other related loans have to be fixed for ten years. before entering the entrance has created wounds and lessons for the real estate businessman and bankers who lend in that era to this day Especially real estate business people become bad debts, NPL (Non-Performing Loan), chasing assets until NPA (Non-Performing Asset) inferior quality assets fill the whole city. Plus other related loans have to be fixed for ten years. before entering the entrance has created wounds and lessons for the real estate businessman and bankers who lend in that era to this day Especially real estate business people become bad debts, NPL (Non-Performing Loan), chasing assets until NPA (Non-Performing Asset) inferior quality assets fill the whole city. Plus other related loans have to be fixed for ten years. before entering the entrance has created wounds and lessons for the real estate businessman and bankers who lend in that era to this day

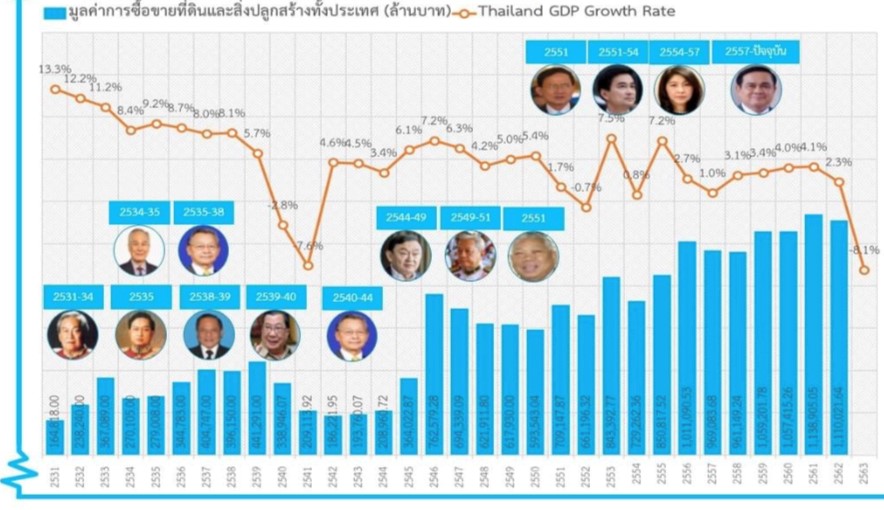

Therefore, if the government of Settha 1 will make real estate come back to prosper must use enormous strength, all internal organs must be gathered into one party Work together more than 100% integrated, even if it can be done, however, it will certainly not be like the national era. The main reason is that real estate will grow in the same direction as GDP, that is, if the country's GDP is positive. The real estate business will also be positive. And similarly if the country's GDP is negative. The real estate business will always be negative. It can be said that the price growth in the real estate business always has a coefficient greater than 1. It is expected that it may even be 2-3, that is, if the coefficient is 2, then GDP growth of 10% is equal to real estate prices will grow 20% as well, and if GDP – 10%, real estate will be negative 20%, etc. Therefore, it can be concluded that GPD is an index indicating the growth of the real estate sector.

Source: Krung Thai Bank

Therefore, when looking back at Thailand's GDP over the past 2-3 years, it has been growing at a level of 3-4% due to the impact of COVID-19 causing both the Thai economy and the global economy to deteriorate. Just started to gradually recover last year. and from the economic forecasts of almost every office. Both the Ministry of Finance and the Bank of Thailand forecast that The Thai economy will grow between 3. 5-4%, not more than this, means that the Thai real estate business will probably be a little better compared to last year. The opportunity to shine brightly in the near future seems unlikely. In addition, we still have to keep an eye on negative factors that may arise. The main one is probably the world economy that has not recovered as quickly as hoped. Plus, China, which is the engine that drives the global economy, is starting to reduce its heat. Acting like it's bad for yourself. The bankruptcy of Evergrande, the giant of Chinese real estate itself. It should show the fragility of the real estate business very well and have quite an impact on the Chinese economy. To hope that China will return as it was before Covid It's even more difficult. China's tourism market And the return of Chinese people to buying real estate in Thailand will definitely not be as lavish as 3-4 years ago.

THE BANGKOK RESIDENCE

"Real Estate for Happiness"

Contact us now

Call Center : 1319

Line @bkkresidence